TALK TO AN EXPERT

Get a free no-obligation consultation. Enter your details below and we'll get back to you.

Home Equity Loans for Seniors

Achieve financial Freedom By Unlocking Equity in Your Home In Canada

What Is a Reverse Mortgage?

A reverse mortgage

is a special type of loan that allows homeowners, typically aged 62 or older, to convert part of the equity in their home into cash. This loan is unique because, instead of making monthly payments to the lender, the lender makes payments to you.

The funds you receive can be used for various purposes, such as supplementing retirement income, paying off existing debts, or covering home repairs. Payments can be structured as a lump sum, monthly installments, or a line of credit.

How a Reverse Mortgage Can Help Seniors

The Choice Is Yours: Use Your Tax-Free Funds the Way You Want

Manage Your Debt Smoothly in Retirement

Leave the Workforce Behind and Retire in Comfort

Ensure Your Standard of Living Stays Strong

Enhance Your Retirement and Enjoy the Next Chapter

How Equinity retirement Got Michael More Equity From His Home

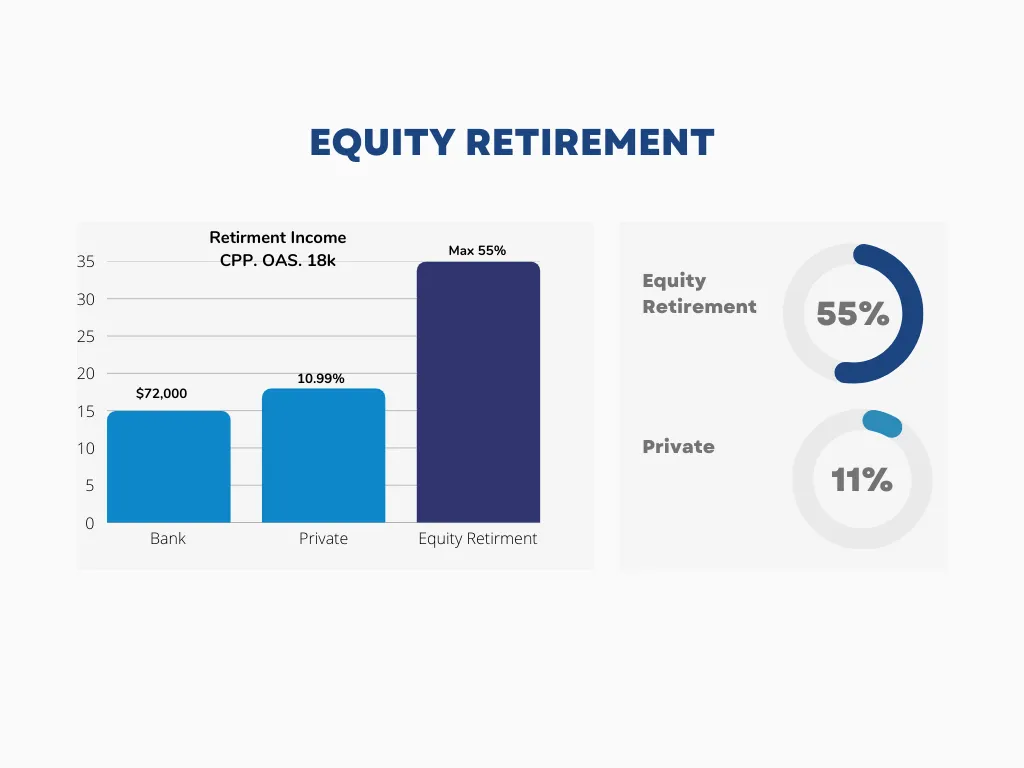

How Much Can I Get From a Reverse Mortgage?

The amount you can get from a reverse mortgage depends on factors like your age, home value, and current interest rates. Generally, the older you are and the more valuable your home, the higher the loan amount. You can receive the

funds as a lump sum, monthly payments, or a line of credit. The loan is repaid

when you sell the home, move out, or pass away.

1. Managing Rising Living Costs & Car Payments"

I was already stretching my pension to cover basic expenses, but when my car lease was up, the new payment was just too much to handle. On top of that, my mortgage renewal came with a higher interest rate that I couldn't afford. I felt stuck-selling my home wasn't an option, but I didn't see another way. Johnny and his team showed me how a reverse mortgage could free up my finances . Now my mortgage is gone, my car payment is manageable, and I can finally breathe. With the cost of everything going up, this was the best decision I could have made.

Robert M., 72, Mississauga, ON

2.Staying in the Family Home & Avoiding Downsizing

My biggest fear was losing the home my late husband and I built together. I wanted to stay, but my fixed income wasn't enough to cover property taxes, maintenance, and everyday bills. My kids were worried I'd have to sell and move into a small apartment. Then I found out about a reverse mortgage.

Johnny

and his team walked me through everything, and now I don't have to move. I can stay in my home comfortably, and I don't have to worry about monthly payments. It gave me peace of mind and the ability to live on my own terms."

Margaret S., 78, Vaughan, ON

3.Paying Off Debt & Eliminating Monthly Payments

I retired with some lingering debt, and it was really starting to stress me out. Between my line of credit, credit cards, and mortgage, I was barely making ends meet. My financial advisor suggested a reverse mortgage, but I wasn't sure if it was the right move. Johnny took the time to explain everything in detail, and I realized it was the perfect solution. Now, all my debt is gone, I have no monthly payments, and I finally feel financially free. I wish I had done this sooner!

John & Linda B., 69 & 67, Oakville, ON

4.Helping Family Without Sacrificing Retirement

As a grandmother, I wanted to help my daughter with a down payment on her first home, but l didn't have the cash to do it. I also didn't want to dip into my retirement savings. A friend suggested looking into a reverse mortgage, and I'm so glad I did. I was able to gift her a down payment, and ! didn't have to give up my own financial security. The best part? I didn't even have to make a single payment! Johnny and his team made the process so easy, and now my daughter is a homeowner while / still get to enjoy my retirement without worry.

Barbara C., 74, Burlington, ON

Why Seniors Work With Equity Retirement.

Higher Loan Approvals

Our special access to low interest rates can help you save thousands

Higher Loan Approvals

We can secure larger loan amounts than you might on your own.

Lower Setup Costs

Reduce your upfront expenses by up to $500.

Expert Support

With our experience and knowledge, we make the process smooth and hassle-free

Our Reserve Mortgage Process

Get a no payment Loan easily in just a few steps

1.Get Expert Guidance on Reverse Mortgages

Discover Your Options with Zero Obligation

2.Pick the Payment Option That Works for You

Funds Available as a One-Time Payment or Dispersed Over Time

3. Sign Your Documents and Move Forward

We Take Care of the Paperwork – Just Sign and Go!.

4. Enjoy the Freedom of Retirement

Relax with a Tax-Free, Payment-Free Loan That Lasts a Lifetime

How Does a Reverse Morgage Work?

A reverse mortgage is a special type of loan that allows homeowners, usually

seniors aged 62 or older, to convert part of their home equity into cash

without having to sell the home or make monthly mortgage payments. Here's how

it works:

Eligibility

Loan Amount

Payout Options

No Monthly Payments

Interest and Fees

Repayment

Retire Equity Learning Center

Comprehensive articles to guide you through everything you need to know.

How a Reverse Mortgage Works in Canada.

How reverse mortgages in Canada differ from those in the United States.

Common myths about reverse mortgages in Canada.

A complete guide to reverse mortgage rates in Canada.

Reaping the advantages of reverse mortgages in Canada.

Comparing Reverse Mortgages and HELOCs in Canada: Key Differences.

Reverse Mortgage Vs. Mortgages for Seniors

The Difference between a Reverse Mortgage, Home Equity Lines of Credit (HELOC) and a Conventional Mortgage

Home Equity Line Of Credit

Fixed Monthly Payments Needed

Must Meet Full Income Criteria

Loan Limit: Up to 65% of Property Value

Flexible Variable Interest Rate

Reverse mortgage

Fixed or Variable Rate? The Choice is Yours

No Regular Payments Required

Minimal Income Requirements Apply

Up to 59% of Property Value

You’ll Never Owe More Than Your Property Value

Conventional mortgage

Fixed vs. Variable Rates Explained

Regular Monthly Payments Apply

Full Income Requirements Apply

Loan Limit: Up to 80% of Property Value

You May Owe More Than Your Home Is Worth

The Complete Guide to a Reverse Mortgage in Canada

Get instant access to our book that explains everything you need to know about a Reverse Mortgage in Canada.

Get expert insights on reverse mortgages that you won't find anywhere else.

Frequently Asked Questions

Find Answers to common questions we receive about reverse mortgages

Can I qualify for a reverse mortgage if I still have an existing mortgage ?

Yes, your current mortgage will be settled using the proceeds from the new loan.The remaining funds will be disbursed to you either as a lump sum or in installments.

Can a reverse mortgage be used to purchase a home?

You can use this no-payment loan for any purpose, including purchasing a home.If you obtain a CHIP Reverse Mortgage directly from HomeEquity Bank, you’ll receive up to 59% of the home’s value.With RetireBetter, you may qualify for a reverse mortgage of up to 65% of the new home’s value.

Is there an age limit for getting a reverse mortgage in Canada?

There is no maximum age to qualify for a reverse mortgage in Canada. In fact, the older you are, the higher the amount you may be eligible for.

Am I eligible for a reverse mortgage if my children live with me?

You can qualify for a reverse mortgage even if your children live with you, as long as they are not listed as owners on the home’s title.Both CHIP Reverse Mortgages and Flex Reverse Mortgages require all titleholders to be at least 55 years old.However, we also work with lenders who offer reverse mortgage options for homeowners under 55.

When and in what way is a reverse mortgage repaid?

You can choose to repay a reverse mortgage at any time.However, repayment is required if you sell the home, move, or pass away.The loan can be repaid by you or your estate using the proceeds from the home sale.

Reverse Mortgage Articles

Get the newest insights and expert advice from our Reverse Mortgage Specialists.

Will you still have home equity after getting a reverse mortgage in Canada?

Can you deplete your equity with a reverse mortgage?

We examine this common belief.

What is the ideal age to get a reverse mortgage in Canada?

Is there a “perfect” time to apply for a reverse mortgage?

Grey Divorce and Reverse Mortgages:

Exploring rising senior divorce rates and how a reverse mortgage can help buy out a spouse with ease.

Our Reverse Mortgage Lenders

ADDRESS:12 Parr BlvdBolton, ON L7E 4H1

CONTACT:

📞(905)-264-1000

Yournesta Financial Dominion Lending Centres Independently Owned & Operated Lic. 13371

Facebook

Instagram

X

LinkedIn

Youtube

TikTok